Travel can be a thrilling journey, but sometimes things happen that you did not plan for. While you likely have car insurance back home, it might not fully extend to rentals. This is where Personal Accident Insurance (PAI) for rental cars steps in, providing an extra layer of security during your trip.

What is PAI and Why is it Important?

PAI is an optional insurance offered by most car rental companies. It protects you and your passengers from financial burdens arising from accidents during the rental period. Here’s why it’s important:

- Medical Costs: Accidents often result in large expenses for health care. PAI helps cover these costs, ensuring you receive proper treatment without worrying about finances.

- Accidental Death Benefit: In the unfortunate event of a fatal accident, PAI provides a pre-determined sum of money to your beneficiaries.

- Peace of Mind: Having the knowledge that you and those travelling with you are protected provides a priceless sense of calm, which lets you concentrate on experiencing joy during your journey.

Understanding Your PAI Coverage:

PAI typically covers:

- Medical Expenses: This includes hospital bills, ambulance services, and doctor consultations.

- Permanent Disability: PAI may offer compensation for permanent disabilities sustained in an accident.

- Accidental Death: A lump sum is paid to the designated beneficiary in case of death due to a covered accident.

Scenarios Where PAI Proves Beneficial:

Imagine you’re on a road trip and get into a collision. You sustain injuries requiring hospitalization. PAI would help manage the medical expenses, ensuring you receive the necessary care. Similarly, if a passenger suffers an accident resulting in permanent disability, PAI could offer financial support during this challenging time.

Exclusions and Limitations to Consider:

It’s essential to understand what PAI doesn’t cover:

- Pre-existing Conditions: PAI usually excludes medical issues you had before the rental period.

- Certain Activities: Extreme sports or driving under the influence might void coverage.

- Limited Coverage Amounts: PAI has pre-defined maximums for medical expenses and death benefits. Review these limits to ensure they meet your needs.

PAI for Rental Cars: Specifics and Distinctions

Rental car companies offer PAI as an add-on during checkout. Remember, it’s different from other types of insurance:

- Collision Damage Waiver (CDW): CDW protects the rental vehicle itself from damage during your rental period.

- Liability Insurance: This covers third-party injuries and property damage caused by your driving.

- Personal Health Insurance: While your health insurance might cover some medical expenses, it might not extend to accidents outside your home country.

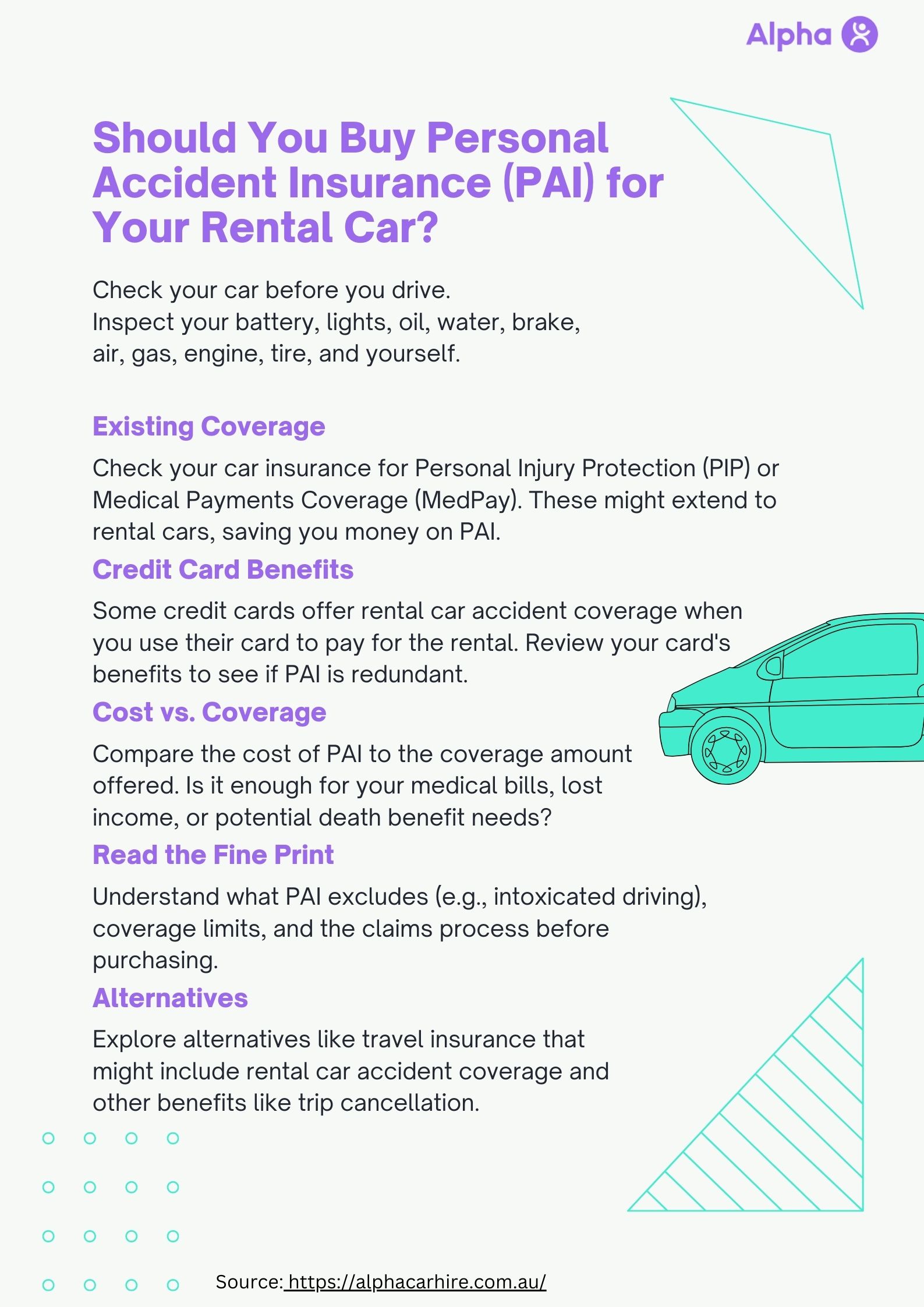

Purchasing PAI: Tips and Considerations

There are two main ways to acquire PAI coverage:

- At the Rental Counter: Most car rental companies offer PAI as an add-on during the checkout process. Review the details carefully before purchasing.

- Stand-Alone PAI Policy: Consider purchasing a stand-alone PAI policy from a third-party insurer. This might offer broader coverage or lower costs compared to rental company PAI.

Choosing the Right PAI Policy:

When selecting a PAI policy, consider these factors:

- Coverage Limits: Ensure the medical expense and death benefit maximums are sufficient for your needs.

- Pre-existing Condition Exclusions: Review the policy wording to understand if your pre-existing conditions are excluded.

- Cost Comparison: Compare the cost of PAI from the rental company versus a stand-alone policy.

PAI vs. Collision Damage Waiver (CDW)

- Collision Damage Waiver (CDW): Protects the rental car itself from damage during your rental period. If you’re at fault in an accident, CDW covers the repair costs of the rental vehicle.

- PAI: Focuses on you and your passengers, providing financial protection in case of an accident. It covers medical expenses and potential death benefits arising from the accident. CDW doesn’t cover medical expenses or passenger injuries.

PAI vs. Loss Damage Waiver (LDW)

- Loss Damage Waiver (LDW): Protects the rental car itself from damage during your rental period. If you’re at fault in an accident, LDW covers the repair costs of the rental vehicle. In some cases, LDW may also cover theft of the rental car.

- PAI: Focuses on you and your passengers, providing financial protection in case of an accident. It covers medical expenses and potential death benefits arising from the accident. LDW doesn’t cover medical expenses or passenger injuries.

PAI vs. Third-Party Liability Insurance

- Third-Party Liability Insurance: This covers any injuries or property damage caused to others involved in an accident where you are at fault.

- PAI: Protects the driver and passengers of the rental car, not third-party injuries or property damage.

PAI vs. Personal Effects Coverage (PEC)

- Personal Effects Coverage (PEC): Safeguards your valuables and personal belongings against damage or loss while they’re inside the rental car.

- PAI: Deals with medical expenses and accidental death benefits for the driver and passengers. It doesn’t cover stolen belongings.

Assessing the Cost-Benefit Ratio

Calculating the Cost:

The cost of PAI varies depending on factors like the rental duration, car type, and chosen coverage level. It typically translates to a daily fee added to your rental car bill.

Weighing the Benefits:

PAI’s value lies in providing financial security in case of an accident. Consider how much peace of mind the coverage offers versus the additional cost. If you’re travelling to a remote location or have limited health insurance coverage, PAI becomes even more crucial.

Is PAI Worth It?

There’s no one-size-fits-all answer. For some travellers, the peace of mind and potential financial protection justify the cost. For others, the existing health insurance coverage or limited travel duration might make PAI less essential.

Making Claims and Dealing with Insurers

Submitting a Claim:

The claims process for PAI depends on your insurance provider. Generally, you’ll need to:

- Gather documentation like the accident report, medical bills, and rental agreement.

- Contact your PAI insurer to initiate the claim process.

- Cooperate with the insurer’s investigation and provide the requested information.

Tips for a Smooth Claims Process:

- File the Claim Promptly: Don’t delay reporting the accident and initiating the claim process.

- Maintain Detailed Records: Keep copies of all relevant documents related to the accident and medical expenses.

- Be Proactive and Communicate Clearly: Stay in touch with your insurer and respond promptly to inquiries.

FAQs about PAI for Rental Cars

Q: Does my health insurance cover rental car accidents?

A: Your health insurance might provide some coverage for medical expenses incurred in a rental car accident. However, it’s important to understand the limitations. Health insurance coverage might not extend to accidents outside your home country. Review your policy details or contact your provider to confirm coverage specifics for rental car accidents.

Q: Is PAI a replacement for car rental insurance?

A: No, PAI serves a different purpose than car rental insurance. PAI focuses on protecting you and your passengers financially in case of an accident. It covers medical expenses and potential death benefits arising from the accident. Car rental insurance, on the other hand, protects the rental vehicle itself and covers third-party liability. This means it pays for repairs to the rental car if you’re at fault in an accident and also covers any injuries or property damage caused to others involved in the accident. Therefore, both PAI and car rental insurance offer essential but distinct types of coverage.

Q: Can I decline PAI if I have my car insurance?

A: Yes, you can decline PAI if you have car insurance. However, it’s crucial to review your car insurance policy carefully to understand its coverage for rental car accidents. Not all car insurance policies extend full coverage to rentals. Your policy might have limitations on coverage amounts, geographic areas, or types of vehicles. By understanding your existing car insurance coverage, you can decide whether to purchase additional protection through PAI.

Q: What if I’m already covered by travel insurance?

A: Travel insurance might offer some overlap with PAI, but reviewing the details of both policies is important. Travel insurance typically covers trip cancellation, medical expenses, and lost luggage, while PAI focuses specifically on accidents during the rental period. Consider if your travel insurance offers sufficient medical coverage for accidents and factor that into your decision on PAI.

Q: Can I use a credit card that offers rental car insurance instead of PAI?

A: Some credit cards provide car rental insurance as a benefit. However, carefully review the coverage details. Credit card rental car insurance often has limitations, such as specific car classes excluded or lower coverage amounts compared to PAI. Ensure your credit card’s coverage aligns with your needs before relying solely on it.

Q: Is PAI mandatory to rent a car?

A: No, PAI is entirely optional. The decision to purchase it depends on your circumstances and risk tolerance.

Q: How can I compare the cost of PAI from different sources?

A: Contact the rental car company and any third-party insurers you’re considering for PAI quotes. Be sure to compare coverage limits and exclusions when evaluating the cost.

Q: What happens if I get into an accident while intoxicated and I have PAI?

A: PAI policies typically exclude coverage for accidents caused by driving under the influence of alcohol or drugs. Driving intoxicated is illegal and extremely dangerous, so it’s crucial to avoid it altogether.

Q: Does PAI cover my personal belongings stolen from the rental car?

A: No, PAI focuses on medical expenses and accidental death benefits for the driver and passengers. For coverage of belongings stolen from the rental car, consider purchasing Personal Effects Coverage (PEC) which is often offered as a separate add-on by rental car companies.

Q: Can I use PAI if I’m renting a car for business purposes?

A: Most PAI policies cover accidents irrespective of whether the rental is for business or leisure. However, it’s advisable to double-check the specific wording of the policy to ensure business use is included.

Q: What if I have pre-existing medical conditions? Will PAI still cover me?

A: PAI policies might exclude coverage for medical conditions you had before the rental period. Review the policy details to understand what pre-existing conditions are excluded and how they might impact coverage. If you have concerns, consult with the PAI provider for clarification.

Conclusion

Personal Accident Insurance (PAI) for rental cars offers valuable protection and peace of mind while travelling. By understanding its benefits, limitations, and how it works alongside other insurances, you can make an informed decision. PAI ensures financial security in case of an unforeseen accident, allowing you to focus on enjoying your travels with a lighter heart. Consider PAI as an investment in a stress-free and secure travel experience.

Alpha Car Hire: Your Trusted Partner for Secure Rentals

At Alpha Car Hire, we understand the importance of a secure and stress-free travel experience. That’s why we offer a variety of insurance options to give you peace of mind on the road. Choose from comprehensive coverage plans or add-on options like PAI to customize your rental car protection.

Don’t let unexpected events disrupt your travels. Visit Alpha Car Hire: link to Alpha Car Hire website today to learn more about our insurance options and find the perfect rental car for your next adventure!