When hiring a car in Australia, you’ll often see “Liability Insurance Coverage” (LIC) listed as part of the rental price. But what does it really mean? And does it fully protect you?

In this guide, we’ll break down:

- What LIC includes (and doesn’t)

- Why it’s important for renters

- How it compares to other insurance types

- What Alpha Car Hire offers to help you stay protected

🚘 What Is Liability Insurance Coverage (LIC)?

Liability Insurance Coverage (LIC) is the basic, mandatory insurance required by law for all vehicles on public roads in Australia. It’s often referred to as Compulsory Third Party (CTP) insurance. Its primary purpose is to protect a driver from financial claims made by other people who are injured or whose property is damaged in an accident that is your fault.

It’s a critical legal requirement, but it’s essential to understand its very specific limits.

✔️ LIC Typically Covers:

- Third-party bodily injury: This covers medical expenses, loss of income, and other related costs for people you injure in a motor vehicle accident.

- Third-party property damage: This covers the cost of damage to another person’s car or property (e.g., a fence, a lamppost) if you are the at-fault driver.

❌ LIC Does NOT Cover:

- Damage to the rental car itself: The most significant exclusion. This includes everything from minor scratches and dents to major accident damage.

- Injuries to the driver (you): LIC only protects third parties, not you, the driver.

- Excluded parts: Damage to the windscreen, tyres, roof, underbody, or the loss of keys are not covered.

- Excess liability: If you are at fault, LIC doesn’t absolve you from paying the rental company’s excess, which can be thousands of dollars.

📌 In other words, LIC protects others on the road — not you or the rental vehicle you are driving.

🔍 Why LIC Alone Is Not Enough

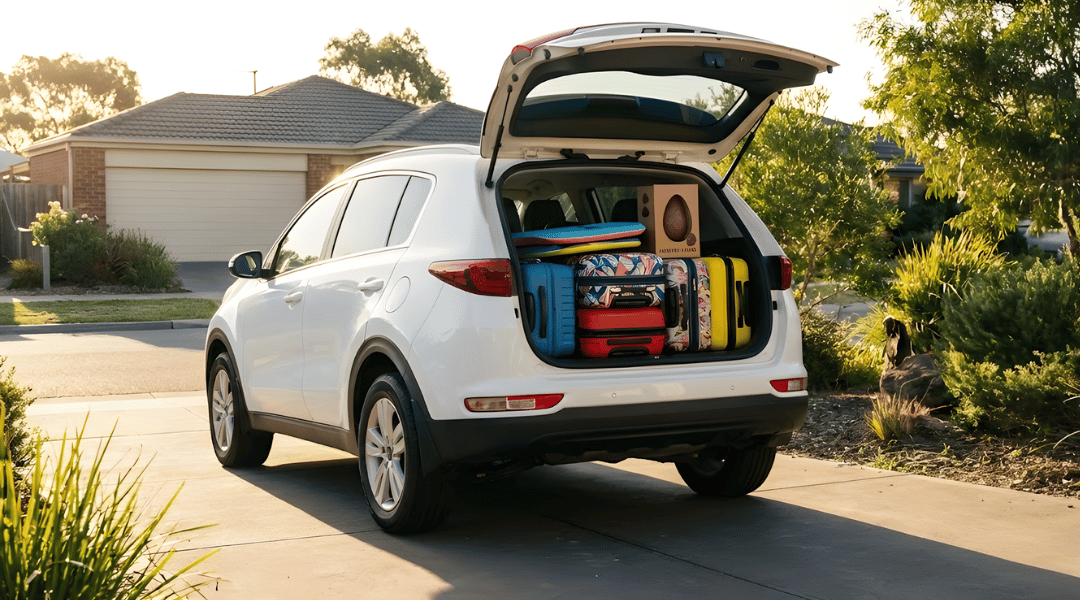

The biggest trap for car renters is assuming LIC means they’re fully protected. But in most rental agreements, you’re still financially responsible for a wide range of incidents that can happen during a trip.

These expenses fall under your excess, which is the maximum amount you must pay out-of-pocket for any claim. This can be as high as $3,000 to $5,000+ unless you reduce it with extra protection.

Without additional coverage, you are liable for:

- Accidental damage to the rental car, even if it’s minor.

- Theft, vandalism, or weather-related incidents like hail damage.

- Vehicle recovery and towing fees after an accident.

- Minor but expensive issues like a tyre puncture, cracked windscreen, or a lost key.

🆚 LIC vs. Protection Plus: What’s the Difference?

To help you choose the right level of cover, here’s a simple comparison of basic LIC and Alpha’s recommended Protection Plus package.

| Feature | Liability Insurance (LIC) | Alpha Protection Plus |

| Required by law? | ✅ Yes | ❌ Optional, but highly recommended |

| Covers 3rd party damage? | ✅ Yes | ✅ Yes |

| Covers damage to rental car? | ❌ No | ✅ Yes |

| Reduces excess? | ❌ No | ✅ Yes (to a much lower amount, or even $0, depending on the vehicle class) |

| Includes roadside assistance? | ❌ No | ✅ Yes, for a variety of common issues |

| Covers windscreen, tyres, keys? | ❌ No | ✅ Yes |

| Provides peace of mind? | ❌ No | ✅ Yes, for a worry-free road trip |

✅ Protection Plus is your best option if you want full peace of mind during your trip.

🧾 Real Example: What Happens Without Full Cover?

Scenario: You’re in Brisbane and accidentally reverse into a pole in a supermarket car park, damaging the back bumper of your rental car. No one else is involved.

- With LIC only: LIC won’t cover the damage to the rental car, because it only protects third parties. You’ll be charged your full excess (up to $5,000) by the rental provider to cover the repair.

- With Protection Plus: You would pay a significantly reduced excess, or in some cases, nothing at all. You would also have access to 24/7 roadside assistance, making the post-accident process much simpler and less stressful.

🚗 Alpha Car Hire: Your Insurance Options

When you rent with Alpha, you automatically receive basic Liability Insurance Coverage. However, we highly recommend upgrading to Protection Plus for complete confidence.

- ✅ Standard Cover (Included): This is the basic, legally required LIC. It covers your liability for damage to third parties and their property.

- Excess: $3,300 to $5,000, depending on the vehicle class.

- ✅ Protection Plus (Add-on): This package is designed to provide comprehensive coverage and peace of mind.

- Reduces excess to as low as $0.

- Includes: Damage to windscreen, tyres, and underbody; roadside assistance for common issues; lost key cover; and towing costs.

👉 Learn more about your options and get answers to frequently asked questions on our Damage & Insurance FAQ page.

🛑 Important Tips Before You Drive

- ✔️ Inspect the vehicle: Always do a walkthrough with a staff member and take your own timestamped photos and videos of the car’s exterior, interior, and dashboard.

- ✔️ Read the fine print: Carefully read the insurance section of your rental agreement to understand any exclusions.

- ✔️ Avoid unauthorised use: Steer clear of off-road driving, unsealed roads, or any other use that may void your insurance.

- ✔️ Ask questions: Our friendly staff are here to help. Ask if you’re unsure about any terms or what your excess covers.

💡 Final Takeaway

LIC is required and helpful — but it is not enough to protect you. Without extra protection, you could still face large out-of-pocket costs for damage to your rental car.

For complete confidence during your car hire experience, opt for Protection Plus. It’s the smartest way to protect yourself, your wallet, and your road trip.