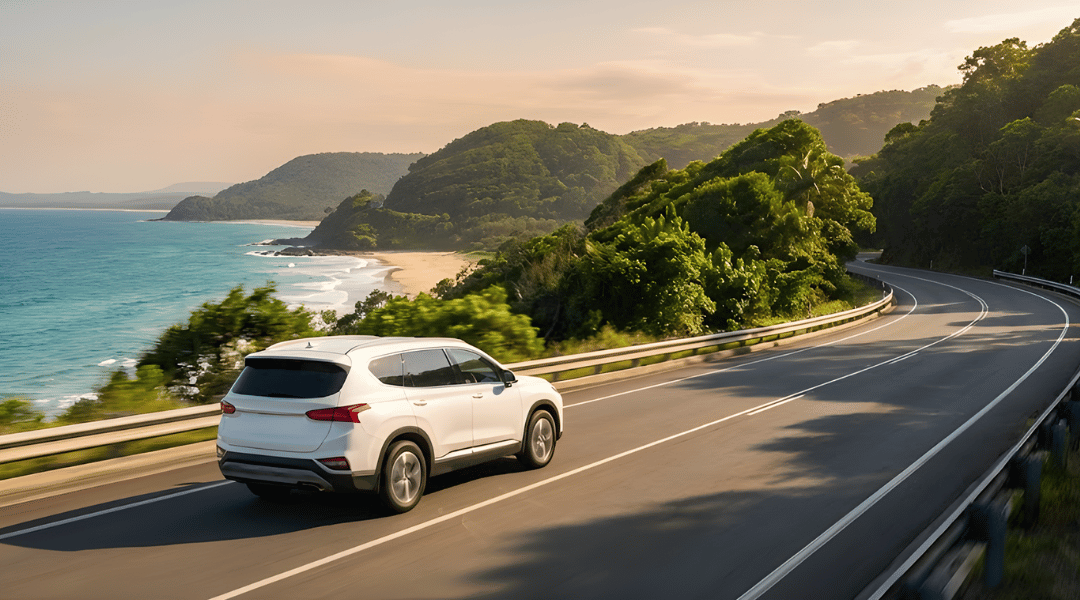

Dreaming of a new car? Perhaps you’ve envisioned yourself cruising along the iconic Great Ocean Road or tackling the urban sprawl of Melbourne in a fresh set of wheels. While finding the perfect vehicle is undeniably exciting, the true ‘key’ to unlocking a good deal often lies with something else entirely: your credit score. It’s a numerical representation of your financial reliability, and it holds immense sway over your borrowing power.

In Australia, your credit score is a crucial factor lenders use to assess your creditworthiness. It directly influences whether you’ll even be approved for a car loan, the interest rate you’re offered, and ultimately, the total cost of your finance. A strong score can translate into thousands of dollars in savings over the life of your loan, making that dream car a much more affordable reality. Conversely, a lower score can lead to higher interest rates, stricter loan terms, or even a complete rejection, forcing you to consider alternatives like a car rental for longer periods.

Despite its profound impact, many Australian consumers are surprisingly unaware of how their credit score works, what factors contribute to it, or how it can significantly affect their ability to secure affordable car finance. This lack of understanding can leave buyers vulnerable to less favourable loan conditions.

This blog post aims to demystify the world of credit scores and car loans for Australian buyers. We’ll dive into what a credit score truly is, how it profoundly impacts your car loan application, the various factors that influence this vital number, practical steps on how to check and improve your score, and essential tips for navigating the car finance application process with confidence.

What is a Credit Score?

For Australian consumers, understanding your credit score is fundamental to navigating the financial landscape, especially when considering a significant purchase like a car. It’s more than just a number; it’s a snapshot of your financial history and an indicator of your reliability as a borrower.

- Definition: A credit score is a numerical representation, typically ranging from 0 to 1200 or 0 to 1000, that summarises your creditworthiness. It’s calculated based on the information compiled in your credit report, which details your financial behaviour over time. Lenders use this score as a quick and effective tool to gauge the risk of lending money to you. A higher score signifies a lower risk, indicating you’re more likely to meet your financial obligations, while a lower score suggests a higher risk of default.

- Key Credit Reporting Bodies in Australia: In Australia, there are three primary credit reporting bodies (CRBs) responsible for collecting and maintaining your credit information:

- Equifax (formerly Veda Advantage) is arguably the most common and widely used.

- Experian

- Illion (formerly Dun & Bradstreet) It’s important to understand that while these CRBs draw from similar data, each uses its own proprietary algorithm to calculate your score. This means you might have slightly different credit scores with each agency, so it’s a good idea to check your report with all of them periodically.

- What a Credit Report Contains (and feeds the score): Your credit report is a detailed history of your interactions with credit. The information within it directly feeds into the calculation of your credit score. Key elements include:

- Personal Information: Basic identifying details such as your name, current and previous addresses, date of birth, and employer.

- Credit Enquiries: Every time you apply for new credit – whether it’s a car loan, a credit card, a personal loan, or even some phone plans – a “hard enquiry” is recorded on your report. Multiple enquiries in a short period can sometimes be viewed negatively.

- Repayment History Information (RHI): Since the introduction of comprehensive credit reporting (CCR) in Australia, this is a significant factor. It details your payment history for the past 24 months, including whether your payments were made on time or if they were overdue by 14 days or more. Consistent on-time payments build a strong RHI.

- Defaults/Overdue Debts: These are significant negative markers. A default is typically listed when a debt of more than $150 remains overdue for 60 days or more and the credit provider has attempted to collect it.

- Court Judgements/Insolvencies: More serious financial events like bankruptcies or debt agreements are also recorded and can severely impact your score.

- Account Information: Details about the types of credit you hold (e.g., mortgages, credit cards, personal loans), your credit limits, and the opening and closing dates of these accounts.

- Score Ranges: Credit score ranges vary by CRB. Here are typical ranges and their general indications for Australian consumers:

- Equifax: 0-1200 (Excellent: 853-1200, Very Good: 735-852, Good: 661-734, Average: 460-660, Below Average: 0-459)

- Experian: 0-1000 (Excellent: 800-1000, Very Good: 700-799, Good: 625-699, Fair: 550-624, Below Average: 0-549)

- Illion: 0-1000 (Excellent: 800-1000, Great: 700-799, Good: 500-699, Room for Improvement: 300-499, Low Score: 1-299) Generally, a score in the “Good” or higher range makes you a more attractive borrower, while scores in the “Average” or “Below Average” categories signal higher risk to lenders.

How Your Credit Score Impacts Your Car Loan

Your credit score is a powerful determinant in the Australian car loan landscape, directly influencing how lenders perceive you and, consequently, the terms of your finance. Understanding its impact can literally save or cost you thousands of dollars.

- Interest Rates: This is perhaps the most significant impact.

- Good Score = Lower Rates: If you have an excellent or very good credit score, lenders view you as a low risk. They are confident in your ability to make repayments on time, and as a result, they’re willing to offer you their most competitive, lower interest rates. This can translate into substantial savings over the loan term.Poor Score = Higher Rates: Conversely, if your credit score is low, lenders perceive you as a higher risk. To compensate for this perceived risk, they will charge you a significantly higher interest rate. This dramatically increases the total cost of the car over the life of the loan.

- With an excellent credit score, you might secure an interest rate of 6.5% p.a. Your total repayments would be approximately $35,211 (including a $250 establishment fee as per some major banks).

- With a poorer credit score, you might only qualify for a loan at 12.5% p.a. In this scenario, your total repayments could skyrocket to around $41,250. That’s a difference of over $6,000 on a $30,000 car, purely due to your credit score!

- Loan Approval: A very low credit score can often result in your car loan application being rejected outright. Lenders typically have minimum credit score thresholds, and if your score falls below this, they may not even consider your application, regardless of your income or other assets. It simply flags you as too risky for their standard lending criteria.

- Loan Terms & Conditions: Even if you are approved with a lower credit score, the terms and conditions of your loan will likely be much less favourable:

- Higher Deposit Requirements: Lenders may demand a larger upfront deposit to reduce their risk exposure, meaning you’ll need to contribute more of your own cash.

- Shorter Loan Terms: To mitigate risk, lenders might offer shorter loan terms (e.g., 3 years instead of 5 or 7). While this means you pay less interest overall, your monthly repayments will be significantly higher, potentially straining your budget.

- Fewer Lender Options: Your choices may be limited to “non-conforming” or “sub-prime” lenders who specialise in higher-risk borrowers. These lenders typically charge much higher interest rates and fees, and their loan products often come with less flexible terms.

- Maximum Loan Amount: Lenders may also cap the maximum amount they are willing to lend to individuals with lower scores, regardless of the vehicle’s price. This might mean you can’t afford the car you desire or have to settle for a cheaper, older model.

- Repayment Burden: A higher interest rate directly translates to a larger portion of your regular repayments going towards the interest charged by the lender, rather than paying down the principal amount of the loan. This makes the loan harder to pay off and means you’re effectively paying more for the same vehicle over time.

Factors That Influence Your Credit Score (What Lenders Look At)

Your credit score is not just an arbitrary number; it’s a dynamic reflection of your past financial behaviour, meticulously compiled from various data points on your credit report. Lenders analyse these factors to determine your creditworthiness and the level of risk associated with lending you money for a car loan.

- Repayment History (Most Important): This is by far the most significant factor influencing your credit score in Australia, particularly since the advent of Comprehensive Credit Reporting (CCR). Lenders want to see if you pay your debts on time. This includes payments for loans (personal loans, mortgages, previous car loans), credit cards, and even some utility bills or phone contracts if they are reported to credit bureaus. Consistent, on-time payments contribute positively, demonstrating reliability. Conversely, late payments (even by a few days, though generally reported after 14 days overdue and a default for 60+ days overdue) are a major red flag and can significantly drag your score down.

- Amount of Debt Owed: The total amount of debt you currently owe across all your credit accounts is a key indicator. High credit card balances, especially if they are close to your credit limit, or carrying many outstanding loans, can signal financial stress to lenders. Your credit utilisation ratio—the amount of credit you’re currently using compared to your total available credit limit—is closely scrutinised. A high ratio (e.g., using more than 30-50% of your available credit) can negatively impact your score.

- Length of Credit History: A longer history of responsible credit use is generally viewed more favourably. It provides lenders with more data to assess your long-term financial behaviour. Newer credit accounts or a very short credit history can sometimes result in a lower score simply because there isn’t enough information for lenders to fully assess your risk.

- Types of Credit Used: Having a healthy mix of different types of credit (e.g., a mortgage, a credit card, and a personal loan) that you have managed responsibly can be a positive factor. It demonstrates your ability to handle various forms of debt effectively. However, it’s about quality over quantity; simply having many types of credit without responsible management can be detrimental.

- New Credit Applications (Credit Enquiries): Each time you apply for new credit and a lender accesses your credit report (a “hard enquiry”), it leaves a mark on your report. While one or two applications won’t significantly hurt your score, too many applications in a short period (e.g., within 6 months) can be a red flag. It suggests you might be desperate for credit, potentially in financial distress, or taking on too much debt too quickly, which increases your risk profile.

- Defaults, Bankruptcies, Court Judgements: These are the most severe negative markers on your credit report and have a long-lasting, significant impact on your credit score.

- Defaults: A payment default occurs when a debt of $150 or more is overdue by 60 days or more, and the credit provider has attempted to collect it. Defaults typically remain on your credit report for five years, even if paid.

- Bankruptcies and Debt Agreements: These formal insolvency events are recorded and have an extremely detrimental effect, generally remaining on your report for five years or longer depending on the circumstances.

- Court Judgements: Any court-ordered debts against you will also be listed and can impact your score for five years.

- Identity Theft/Fraud: Unfortunately, if you become a victim of identity theft or fraud, and fraudulent accounts or activity are linked to your name, it can severely impact your credit score. It’s crucial to monitor your credit report for suspicious activity.

How to Check and Improve Your Credit Score Before Applying

Taking proactive steps to understand and improve your credit score before applying for a car loan can make a substantial difference to your approval chances and the loan terms you secure. It requires diligence and consistent good habits.

- Get Your Free Credit Report: The first and most crucial step is to know what’s on your report. You are legally entitled to one free copy of your credit report every 12 months from each of Australia’s three main credit reporting bodies: Equifax, Experian, and Illion. You can request these directly from their websites.

- Check for Accuracy: Once you have your reports, meticulously review them for any errors, inaccuracies, or outdated information. This could include incorrect personal details, accounts you don’t recognise, or defaults that have been unfairly listed.

- Dispute Errors Immediately: If you find any discrepancies, dispute them immediately with the relevant credit reporting body and the credit provider who listed the information. They are legally obliged to investigate your claim. Correcting errors can quickly boost your score.

- Pay Bills on Time, Every Time: This is the single most effective way to improve and maintain a healthy credit score under Australia’s Comprehensive Credit Reporting (CCR) system. Your repayment history for the past 24 months heavily influences your score.

- Set up Reminders: Implement direct debits for minimum payments, calendar reminders, or automated alerts to ensure you never miss a due date for credit cards, loans, or even utility bills that are reported.

- Reduce Existing Debt: Lenders prefer to see that you manage your debt responsibly.

- Pay Down Credit Cards: Focus on paying down high-interest credit card balances and personal loans. Aim to keep your credit utilisation ratio low (ideally below 30% of your available credit limit). This shows you’re not over-reliant on credit.

- Avoid Multiple Credit Applications: Each “hard enquiry” from a credit application (for loans, credit cards, or even some phone plans) can slightly ding your score.

- Strategic Applications: Only apply for credit when genuinely needed. Avoid making numerous applications in a short timeframe, as this can make you appear desperate for credit and increase your perceived risk to lenders. Research lenders and loan products thoroughly before submitting an application.

- Don’t Close Old Accounts (Wisely): While it might seem counter-intuitive to keep old, paid-off credit cards, an established, well-managed credit account with a long history of on-time payments can actually boost your score. It demonstrates a consistent track record of responsible credit use. However, if an old account has an annual fee or temptation to overspend, closing it might be a better personal financial decision, even if it has a minor, temporary impact on your score.

- Be Patient: Improving a credit score is not an overnight process. It takes time and consistent good financial habits. Negative entries like defaults can remain on your report for five years, but their impact diminishes over time, especially as you build a new history of positive repayment behaviour. Focus on sustainable changes, and your score will gradually improve.

Tips for Applying for a Car Loan (With Your Credit Score in Mind)

Once you’ve done your homework and, ideally, worked on improving your credit score, approaching the car loan application process strategically can significantly enhance your chances of securing the best possible deal.

- Know Your Score First: Never apply for a car loan blind. Before you even start Browse vehicles or speaking to finance providers, obtain copies of your credit report and understand your current credit score from all three major CRBs (Equifax, Experian, and Illion). This knowledge empowers you to set realistic expectations and identify any potential issues beforehand.

- Get Pre-Approved: Obtaining pre-approval for a car loan from your bank, credit union, or an online lender before you visit the dealership is a highly recommended strategy. Pre-approval gives you a clear understanding of exactly how much you can borrow, the interest rate you’re likely to receive, and your estimated monthly repayments. This not only gives you strong negotiating power with dealerships (as you already have finance arranged), but it also helps you stick to a realistic budget and avoid high-pressure sales tactics from in-house finance teams.

- Compare Comparison Rates: When looking at loan offers, always pay close attention to the comparison rate, not just the advertised interest rate. In Australia, the comparison rate includes the interest rate plus most fees and charges associated with the loan, giving you the true, overall cost of the finance. This allows for an ‘apples-to-apples’ comparison between different lenders.

- Consider a Larger Deposit: If your budget allows, offering a larger upfront deposit can be beneficial. It reduces the total amount you need to borrow, which can potentially lead to a lower interest rate (as the lender’s risk is reduced), lower monthly repayments, and a shorter loan term. It also demonstrates strong financial discipline.

- Be Realistic About What You Can Afford: Even if you’re approved for a certain loan amount, it doesn’t necessarily mean you should borrow that much. Carefully assess your personal budget, income, and existing expenses to determine what you can comfortably afford in monthly car repayments without experiencing financial strain. Don’t overstretch yourself for a vehicle that’s beyond your means.

- Avoid High-Pressure Sales: Dealership finance departments often operate with sales targets and may try to push you into signing up for their finance on the spot. Don’t fall for high-pressure sales tactics. Take your time to review all loan contracts, terms, and conditions thoroughly. If something isn’t clear, ask questions. If you feel pressured, walk away and review the offer calmly at home or seek independent financial advice. Having your pre-approval in hand makes it easier to resist these pressures.

Conclusion

In the competitive landscape of car finance in Australia, your credit score stands out as a powerful and indispensable tool. As we’ve explored, understanding what it is, how it’s calculated, and its direct influence on your car loan terms is paramount. Protecting it through timely payments, managing debt wisely, and improving it with consistent good financial habits can truly save you thousands of dollars in interest and unlock access to more favourable financing options.

Don’t let your credit score passively dictate your car loan terms. Take the wheel, proactively understand your financial standing, and confidently navigate your path to a great deal on your next vehicle. Your proactive approach today will pay dividends on the road ahead. We encourage you to check your free credit report today and gain clarity on your financial position. Share your experiences with credit scores and car loans in the comments – your insights could help other Australian buyers!

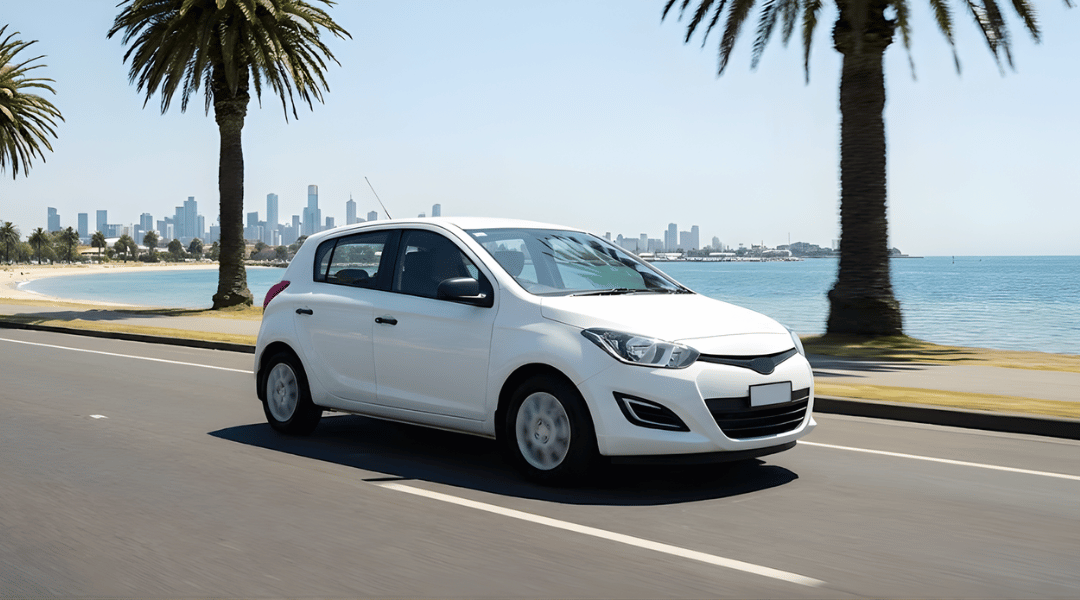

Wide Range of Vehicles for Your Melbourne Airport Pick-up

Arriving at Melbourne Airport and ready to hit the road? Alpha Car Hire offers a wide range of modern, well-maintained vehicles to suit every travel need, ensuring a smooth start to your journey. From economical compact cars perfect for city exploring to spacious SUVs and people movers for family adventures, we have the ideal set of wheels for your Melbourne pick-up. Our convenient off-airport location with a complimentary shuttle service means you can skip the queues and get on your way faster. Browse our extensive fleet and book your perfect Melbourne Airport car hire with Alpha Car Hire today!