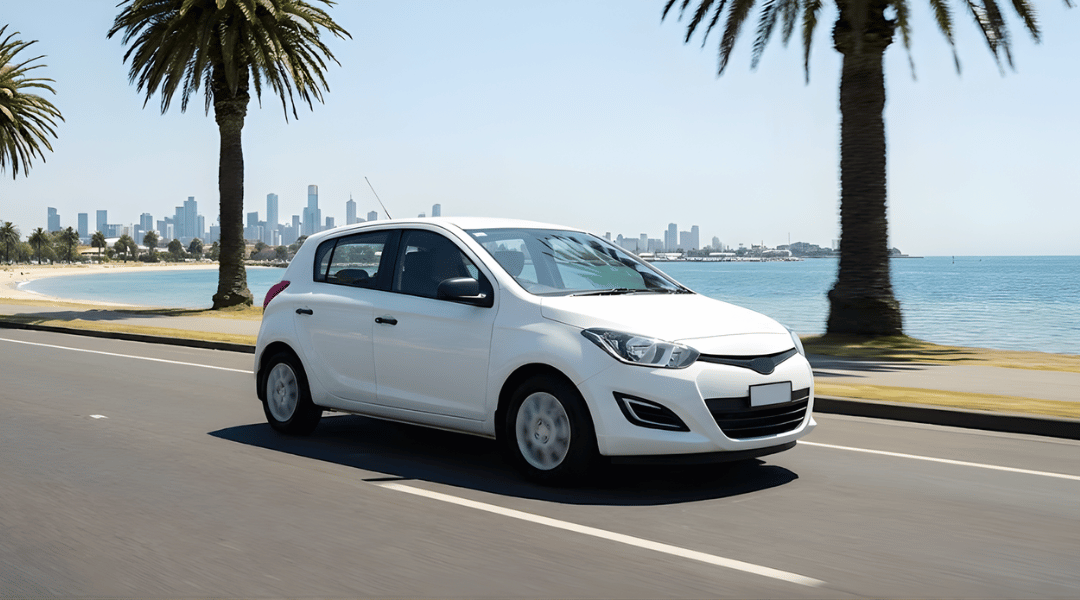

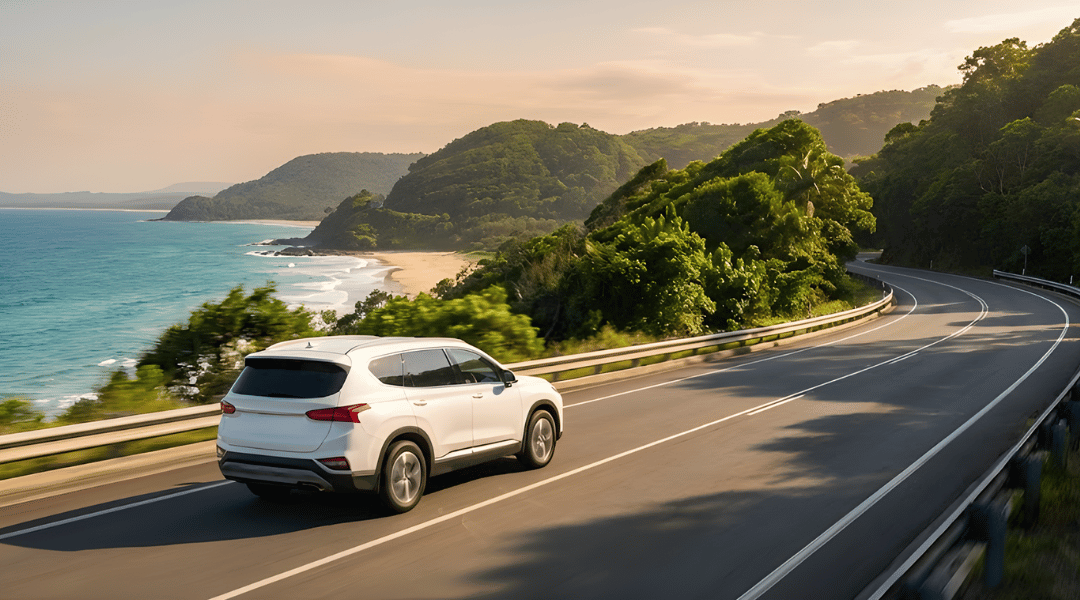

In Australia’s dynamic mobility landscape, getting around isn’t just about owning a car anymore. A new player has entered the game – car subscriptions – offering a compelling alternative to traditional options like outright ownership, fixed-term leasing, and long-term rentals. But with so many choices, how do you know which is the best fit for your lifestyle and wallet?

This comprehensive guide will break down each option, compare their pros and cons, and help you decide whether the buzz around car subscriptions is right for your needs Down Under.

Understanding Your Options: A Closer Look

Before we dive into a direct comparison, let’s briefly define each of the main ways Australians can get behind the wheel:

1. Outright Car Ownership (Buying)

This is the most conventional method, where you purchase a vehicle, either outright with cash or through a car loan. You hold the title and have complete control over the car.

Pros:

- Full Control & Customisation: You can modify the vehicle, drive unlimited kilometres, and use it as you see fit without restrictions (within legal limits).

- Asset & Equity: The car is an asset that can appreciate (rarely, but possible with classics) or, more commonly, be sold when you no longer need it, allowing you to recoup some of your initial investment.

- No Ongoing Payments (Post-Loan): Once any loan is paid off, you no longer have recurring car payments (though running costs remain).

- Tax Deductions for Business Use: For individuals or businesses, certain expenses like fuel, repairs, and depreciation can be claimed if the car is used for work-related purposes.

Cons:

- High Upfront Costs: Significant initial outlay for the purchase price, stamp duty, registration, and initial insurance can be a major hurdle.

- Depreciation Risk: Cars are a rapidly depreciating asset; they lose value significantly over time, especially new cars. This is a direct financial loss to the owner.

- Ongoing & Unpredictable Costs: You are solely responsible for all running costs, including registration, insurance (CTP is mandatory in Australia), servicing, maintenance, and unexpected repairs. These can be unpredictable and costly.

- Hassle of Selling: When you want to upgrade or no longer need the car, you face the often time-consuming and sometimes stressful process of selling a used vehicle.

- Commitment: You’re locked into the car until you sell it, limiting flexibility if your needs change.

2. Car Leasing (Novated, Finance, Operating)

Leasing involves paying a regular fee to use a car for a fixed period (typically 2-5 years), after which you usually return the car, extend the lease, or purchase it at a pre-determined residual value. Novated leases, often arranged through employers, are popular in Australia for their potential tax benefits.

Pros:

- Lower Monthly Payments: Lease payments can often be lower than loan repayments for the same vehicle, as you’re only paying for the depreciation during the lease term, not the full purchase price.

- Access to Newer Vehicles: Leasing allows for regular upgrades, typically every two to four years, ensuring you drive a car with the latest features and technology.

- Potential Tax Benefits: For businesses or through novated leases, payments can often be tax-deductible, providing financial advantages.

- Reduced Maintenance Worries: Many lease agreements include manufacturer warranties and scheduled servicing, reducing unexpected maintenance expenses.

Cons:

- Long-Term Commitment: Leases typically involve fixed contracts, making early termination costly due to significant penalties and residual value payouts.

- Mileage Restrictions: Most leases come with strict kilometre limits. Exceeding these can result in hefty fees at the end of the term.

- No Ownership/Equity: You don’t own the car and won’t build equity. At the end of the term, you return it or pay a large residual value to purchase it.

- Wear and Tear Penalties: You may be charged for excessive wear and tear beyond what’s considered “normal” at the end of the lease.

- Tied to Employer (Novated): If your employment changes, your novated lease arrangements can become complex or cease, potentially leaving you liable for the vehicle.

3. Long-Term Car Rental

This involves renting a car for an extended period, typically from a few weeks to several months, from a traditional rental company. It’s more flexible than leasing but generally less comprehensive than a subscription.

Pros:

- Short-Term Flexibility: Ideal for specific, temporary needs like extended holidays, seasonal work, or when your primary car is being repaired.

- No Ownership Responsibilities: Like subscriptions, you avoid maintenance, servicing, and depreciation worries.

- Often Cheaper than Short-Term Daily Rentals: Daily rates are usually reduced for longer rental periods.

Cons:

- Potentially Higher Costs: While cheaper than short-term rentals, long-term rentals can still be more expensive than subscriptions over extended periods, especially when all costs like additional insurance, premium location fees, and fluctuating rates are factored in.

- Less Inclusive: Often, insurance coverage is basic, and maintenance inclusions might not be as comprehensive as with subscriptions. Hidden fees or extra charges for mileage, refuelling, and additional drivers can add up.

- Older Fleet & Limited Swaps: Rental fleets can sometimes be older with higher wear and tear compared to subscription services, and vehicle swap options are less common or more restrictive.

- Customer Service & Reliability Concerns: Some users report less proactive customer service or older vehicles prone to issues compared to subscription services, which aim for a premium, hassle-free experience.

4. Car Subscription

As explored earlier, this model offers access to a car for a recurring fee, typically including most running costs like registration, insurance, servicing, and roadside assistance, with flexible terms and the ability to swap vehicles.

Pros:

- Maximum Flexibility: Short minimum terms (often 1-3 months), easy cancellation, and the ability to swap vehicles frequently to suit changing needs (e.g., small car to SUV).

- Predictable, All-Inclusive Costs: One simple weekly or monthly payment covers almost all car-related expenses, eliminating financial surprises like depreciation, major repairs, or registration renewals.

- No Depreciation Risk: The provider bears the risk of the car losing value.

- Low Upfront Cost: Generally requires a smaller security deposit and first payment compared to buying or leasing.

- Hassle-Free: All administration (rego, insurance, servicing) is handled by the provider.

- Access to Newer Models: Fleets often consist of modern vehicles with the latest technology and safety features.

Cons:

- No Ownership/Equity: You don’t own the car, so you don’t build equity or have an asset to sell.

- Potentially Higher Long-Term Cost (Compared to Paid-Off Car): Over many years, if you keep a purchased car long after its loan is paid off, ownership might be cheaper in total cost, though this excludes the lost opportunity cost of capital and maintenance.

- Mileage Limits: Most subscriptions have kilometre allowances, with extra charges for exceeding them.

- Limited Customisation: You cannot permanently modify the vehicle.

- Availability: While growing, services might not be as widespread in regional or very remote areas as traditional car ownership options.

Comparison Matrix: Finding Your Perfect Fit

To help you decide, here’s a quick comparison of the key aspects:

| Feature | Outright Ownership | Car Leasing (Fixed-Term) | Long-Term Rental | Car Subscription |

| Commitment | Long-term (until sold) | Medium-long (2-5 years) | Short-medium (weeks-months) | Short-term (months, flexible) |

| Flexibility | Low (tied to one car) | Low (tied to one car & term) | Moderate (can extend/end) | High (swaps, easy exit) |

| Upfront Costs | High (purchase, stamp duty) | Moderate (deposit, fees) | Low (bond, first payment) | Low (bond, first payment) |

| Predictable Costs | Low (many variable costs) | Moderate (some inclusions) | Moderate (variable rates/fees) | High (all-inclusive fee) |

| Depreciation Risk | High (your responsibility) | Medium (built into lease) | None (provider’s burden) | None (provider’s burden) |

| Maintenance/Servicing | Your responsibility | Often included (new cars) | Usually included | Always included |

| Insurance | Your responsibility | Sometimes included | Often basic, can upgrade | Always included (comprehensive) |

| Roadside Assist | Your responsibility | Varies | Varies | Always included |

| Vehicle Swaps | No | No | Limited | Yes (major benefit) |

| Asset/Equity | Yes | No | No | No |

| Tax Benefits | Yes (depreciation, expenses) | Yes (lease payments) | Limited | Limited |

| Mileage Limits | None | Yes | Yes | Yes |

Which Option is Best for You, Aussie?

The “best” option isn’t universal; it depends entirely on your individual circumstances, priorities, and lifestyle.

- Choose Outright Ownership If:

- You want complete control over your vehicle and plan to keep it for many years (5+).

- You don’t mind handling all maintenance, insurance, and registration yourself.

- You have a significant upfront sum or are comfortable with a long-term loan commitment.

- You value having an asset, even with depreciation.

- Consider Car Leasing If:

- You enjoy driving a new car every few years but don’t want to own it outright.

- You can accurately predict your annual kilometres and commit to a fixed term.

- You’re a business or want to explore novated lease tax benefits through your employer.

- You want predictable monthly payments for a newer vehicle.

- Opt for Long-Term Rental If:

- You need a car for a specific, temporary period (e.g., several months for a project or extended visit).

- You prefer not to commit to long-term ownership or leasing.

- Your needs are relatively stable for the rental period, and you’re prepared for potential fluctuating costs.

- Explore a Car Subscription If:

- Flexibility is your top priority. Your needs might change often (e.g., new job, family expansion, moving home).

- You want predictable, all-inclusive costs and hate hidden fees or unexpected maintenance bills.

- You want to try out different car types (especially EVs) before committing to a purchase.

- You value convenience and want to offload all the administrative burdens of car ownership.

- You want access to modern vehicles without the depreciation risk.

- You need a car quickly with low upfront costs.

Conclusion

The rise of car subscriptions in Australia reflects a broader shift towards flexible, convenient, and service-based living. While traditional ownership, leasing, and long-term rentals each have their place, car subscriptions offer a compelling alternative, particularly for those seeking predictable budgeting, hassle-free driving, and the freedom to adapt their vehicle to changing needs.

Understanding the nuances of each option is key to making an informed decision for your unique Aussie lifestyle. So, consider your priorities – commitment, cost, convenience, and flexibility – and choose the driving solution that best gets you where you need to go.