In the busy life of driving on Australian roads, it is very important to have proper insurance for your rented car. If you are travelling around the beautiful beaches of Queensland or driving through Sydney’s city areas, knowing about rental car insurance can help you avoid problems and unexpected costs. We’ll explore the various insurance policies for rental cars in Australia and understand their importance.

Types of Rental Car Insurance Policies in Australia

In Australia, you can find different kinds of insurance for rental cars that cover the renter if there is an accident or damage. Usually, these policies have:

1. Collision Damage Waiver (CDW):

What it is: CDW is an optional insurance policy offered by rental car companies.

What it does: It pays for fixing the rental car if it gets harmed in a crash, no matter who is to blame.

Price: The price often changes based on which company you rent from and the kind of car. They normally charge for each day you have the car, and there might be an extra fee you must pay if there’s any damage.

Requirements:

- Must be purchased from the rental car company.

- Typically available for drivers aged 25 and older, although age restrictions may vary.

- Some companies that rent cars might ask for a real driver’s license and also a credit card with the same name as the person renting if they want to buy CDW.

2. Loss Damage Waiver (LDW):

What it is: LDW or Loss Damage Waiver is an extended form of CDW, offering additional protection.

What it does: It protects against harm to the hired car that happens because of crashing, stealing, or deliberate destruction. This protection usually also has what CDW offers.

Price: The price, similar to CDW, changes depending on the rental service and what kind of car you choose. They typically calculate it daily for each day you rent the car and there might be an additional charge as well.

Requirements:

LDW is usually an optional add-on to the rental agreement.

Age and licensing requirements are similar to CDW.

For coverage of Loss Damage Waiver, someone renting may have to show a credit card and there could be additional charges.

3. Supplemental Liability Insurance (SLI):

What it is: SLI or Supplemental Liability Insurance is an optional insurance policy that provides additional liability coverage.

What it does: It provides coverage for harm or injuries to other people if an accident happens with the rental car, adding extra protection on top of what is already in the normal rental contract.

Price: Price changes with different rental services and how much insurance you want. They usually charge for each day you rent.

Requirements:

SLI is typically optional and can be added to the rental agreement.

Drivers may need to meet age and licensing requirements set by the rental company.

To buy SLI, you might have to show a credit card that is in the name of the person renting.

4. Personal Accident Insurance (PAI):

What it is: PAI is a choice for insurance that will pay for medical bills if the driver or people in the car get hurt.

What it does: It offers insurance for the medical costs of injuries received while renting, including payment if there is accidental death or lasting disability from an accident that is included.

Price: The price changes based on different things, like which company you rent from and how much insurance you want. They often charge it for each day you rent.

Requirements:

- PAI is often offered as an optional add-on to the rental agreement.

- Age and licensing requirements may vary among rental companies.

- Renters may need to provide personal information and sign additional paperwork for PAI coverage.

5. Personal Effects Coverage (PEC):

What it is: PEC is an extra insurance that you can choose to cover personal items stored in the hired car.

What it does: It provides insurance for things such as bags, electronic devices, or other important items to protect against stealing, misplacing, or harm while they are being rented.

Price: The price changes based on which company you rent from and how much the things you are insuring are worth. Usually, they charge it for each day you rent.

Requirements:

- PEC is usually an additional insurance choice you can include with the rental contract.

- People who rent might need to tell the insurance company how much their things are worth if they want these items protected with Personal Effects Coverage.

- Age and licensing requirements may apply, similar to other insurance options.

6. Roadside Assistance:

What it is: Roadside Assistance is a service offered by rental car companies.

What it does: It helps when there are problems like a car stopping working, tyres getting punctured or doors that won’t open. It provides help by towing the vehicle, starting it with cables if the battery is dead, changing flat tyres and helping to open locked cars.

Price: This price might be part of the rent amount or it can come as an extra choice. When it is an extra, the price changes based on which rental business you go to and how much protection they give.

Requirements:

- Assistance on the road might come with the rental cost, or you can choose it as an extra service.

- When booking, tenants must ask if roadside help is available and what the conditions are.

- Rental companies might ask customers to inform them right away if there is a breakdown or emergency so they can use the services for help on the road.

Knowing all the parts of each insurance choice, like what it covers, what it does not cover, and how much it costs, can guide people who rent cars to pick the right insurance for their situation.

Factors to Consider When Choosing Rental Car Insurance in Australia

- Coverage Needs: Consider the insurance you require by thinking about how often you drive, how long you will rent the car for, and what model of vehicle it is.

- Existing Coverage: Verify whether your own car insurance or credit card gives you protection for rent vehicles, as it could change the necessity to get extra insurance.

- Rental Company Policies: Understand the different insurance choices provided by the company that rents out vehicles, which includes information on what is covered, what is not included and any extra charges or amounts you have to pay before insurance starts covering costs.

- Cost vs. Benefit: Assess the cost of insurance compared to possible advantages and financial dangers, taking into account things such as how much renting costs, excess charges, and what damages could happen.

- Terms and Conditions: Make sure to look through the small details in the insurance agreement so you can know what limits, rules, and duties you must follow as a person renting.

- Customer Reviews: Check what customers say about their experiences with rental car insurance to understand how trustworthy and good the coverage from various companies is.

- Additional Services: Think about other services that come with the insurance, like help if your car breaks down or insurance for personal items, and decide how much they are worth to you.

Tips for Saving Money on Rental Car Insurance

- Review Existing Coverage: Check the insurance you already have: Use the protection from your own car insurance or credit card so you don’t buy extra that you do not need.

- Shop Around: Look at different places: Look for insurance from various rental businesses to get the best prices and insurance plans that are right for what you need.

- Bundle Coverage: See if you can combine rental car insurance with different insurances like travel insurance so maybe you get a lower price or save some money.

- Consider Excess Reduction: Think about lowering extra costs: Choose the options to reduce your excess fees given by car rental businesses so you pay less from your own money if there is damage to the hired car.

- Avoid Unnecessary Coverage: Say no to extra insurance you don’t require or if you are already covered enough, so as not to spend money on protection that isn’t needed.

- Book in Advance: Make a reservation early: It is good to book your rental vehicle and the insurance before time because sometimes it can be cheaper than doing it just before you need it.

- Membership Discounts: Discounts for Being a Member: Look to see if being part of groups, like programs where you get points for loyalty or organizations related to your job, can give you a lower price on insurance for renting cars.

Frequently Asked Questions

- Is rental car insurance mandatory in Australia?

- No, it is not required to have insurance for a rental car in Australia, but it is very much suggested that you get it to guard against possible financial responsibilities.

- Does my auto insurance cover rental cars in Australia?

- This depends on the policy you have. Some insurance for personal cars might also cover rental vehicles, but it is very important to confirm with your insurance company for specific information.

- What is excess in rental car insurance?

- You need to pay extra money for the repairs or damages of the rental car if there is an accident or someone steals it.

- Can I purchase rental car insurance separately from the rental company?

- Sometimes, you might get the option to buy rental car insurance separately from independent companies. However, usually, it is easier to just get the insurance straight from the company that rents out the cars.

- Are there age restrictions for purchasing rental car insurance in Australia?

- Different rental businesses might change age limits, and this can also depend on what insurance you choose. Some may require you to be a certain age before you can buy their insurance.

Alpha Car Hire: Your Partner for Car Rental in Australia

Alpha Car Hire gives a full set of car renting services in Australia, supplying different cars for many travel purposes. They have easy-to-reach places to pick up and return the vehicles, good prices, and several choices for insurance coverage. Alpha Car Hire aims to make it very smooth for customers when they rent a car.

-

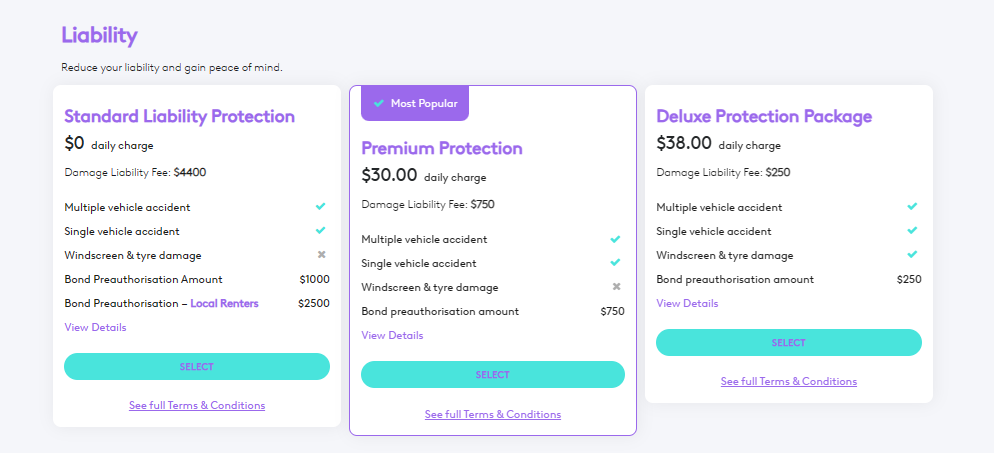

Flexible Insurance Options: Alpha Car Hire has many insurance choices, so people can pick what fits their needs and how much they want to spend, including flexible excess reduction options.

-

Low Prices: Alpha Car Hire has good prices for renting cars, which helps people save money. The costs are clear and there are no extra charges that you don’t know about, so customers can be sure they’re paying a fair amount.

- Diverse Fleet: Alpha Car Hire has a variety of different vehicles, making sure that customers can choose the right one for their travel needs.

- Economy cars: Small, fuel-efficient vehicles suitable for city driving.

- Sedans: Versatile mid-sized cars offering comfort for different trips.

- SUVs: Larger vehicles providing space for families or outdoor adventures.

- Vans: Spacious vehicles ideal for group outings or transporting cargo.

- Trucks: Rugged vehicles designed for hauling heavy loads or equipment.

When customers select Alpha Car Hire for their rental needs, which includes insurance options, they find the service convenient and budget-friendly while feeling secure that they are dealing with a reliable company.

Car Hire Locations